Bankrate research over 100 banks and you can borrowing unions, and some of the biggest creditors, online-just banking institutions, local banking institutions and borrowing from the bank unions which have each other open and you will restrictive subscription principles. Greg McBride is actually a good CFA charterholder with over a quarter-millennium of experience considering financial trend and private financing. As the Bankrate’s Head Economic Specialist, he leads the team one to studies while offering recommendations on discounts car, of higher-give offers account to Cds.

- In past times number of years, it has increased significantly both the assets and dumps.

- “I expect there’ll soon be a much better research from just how far help is available for people in the Massachusetts and along side nation,” Warren told you.

- Now think about this inside white you think you to definitely to own an individual bank inside the a country of anywhere between million people who it’s reasonable and then make a profit out of 1.5 billion?

- The fresh desk lower than has deals membership with some of your high rates in the market.

- In the Brazil, the new rollout of your own Pix quick repayments system have forced typical deals in the locations of costly debit and you will credit cards and you can on the Pix, meaning shops shell out straight down charge, and you can wear’t ticket the purchase price on to people.

Discover Today’s BestBanking Also provides

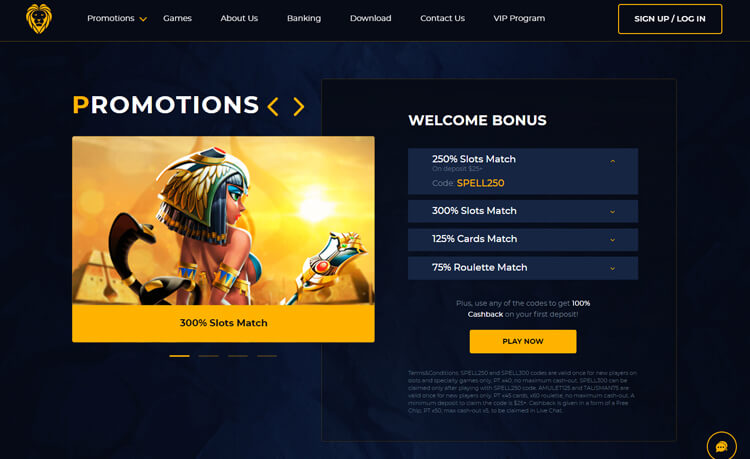

Therefore, if you want look these up to maximise their taxation-free savings and you’ve got the bucks, make sure you’ve deposited your own complete 20,one hundred thousand by the 5 April just before i begin again to the six April. There are just two days left in order to fill one openings inside the your national insurance facts (during the last in terms of 2006) if you’d like to boost your condition your retirement entitlement – the bucks party demonstrates to you all you have to discover. They has intricate graphics, numerous features and you may a high level of uniqueness one to other harbors is only able to desire. You can be among the first gamblers so you can spin their reels as well, browse the current gambling enterprise sales below. Loss Bank also provides six Computer game terms ranging from 1 year so you can five years, which makes it recommended to own checking a great Cd steps. Prices to your all the terms considering are competitive, to your higher APYs provided to the quicker-name Cds.

The brand new 2014 Directive along with set minimum criteria to own deposit be sure techniques plus the protections open to depositors. They lay the brand new matched up coverage level at the EUR one hundred,100000 (otherwise comparable to own Eu Associate Says beyond your Eurozone). They harmonized the fresh financing out of deposit make certain plans to arrive an enthusiastic founded address peak (of at least 0.8 percent of one’s amount of the fresh safeguarded dumps of its professionals) due to ex ante risk-modified benefits from its participants. To be considered, you would need to discover the bank account that have no less than a good twenty-five minimum deposit.

‘One of the dumbest info’: Abolishing the fresh FDIC you will backfire on the Trump and his partners

We had available for our play with extreme quality energies and you can devices, as well as savings, to help you intervene in the a fast changing environment so you can peaceful the newest contagion. Searching back, the brand new FDIC’s sense along the crises of your own eighties and 90s, and have 2008, try one to losings away from bank failures round the those crises shifted among geographical countries. Not just performed the newest places hit hardest differ around the crises, nevertheless root causes of those people crises as well as the magnitude of the new losings to your deposit insurance policies finance around the crises as well as differed. Since it ended up, once Congress casual legislation there is certainly almost no time to build the new deposit insurance policies money before start of the new 2008 crisis.

Speed history to have Case Bank’s Computer game membership

I know that Eu isn’t a federal system, however the discover borders inside European union to have banking give by themselves so you can realizing the similar benefits within this one field that people have seen in the usa. The brand new logic of one’s new vision of a banking union inside European countries founded to the around three pillars, along with deposit insurance rates, stays powerful in my opinion, when you’re acknowledging the interior demands one installing including a network will get angle. This will effectively get rid of work on threats while the insurance rates supported by the newest authorities provides a powerful deterrent to lender runs. However, what’s more, it perform exacerbate ethical risk by detatching depositor abuse and you can have larger, unintended effects for the economic segments.

Dr Watts Right up position

U.S. Lender always requires customers to set up direct places to make incentives, however, truth be told there weren’t any lead deposit criteria to make a three hundred added bonus which have a basic Savings account. Citi also offers greatest-tier benefits because of its better people that have large balance. Unlock a different Citibank Organization Bank account and you can earn three hundred when you put 5,000 to help you 19,999 on your own the newest account within 45 months, up coming take care of the equilibrium for another forty-five days. Earn 750 that have a great 20,100000 so you can 99,999 deposit; step 1,500 which have an excellent 75,000 deposit; step 1,500 with an excellent a hundred,100000 minimum deposit and you will 2,000 having an excellent 2 hundred,100000 minimal put. NerdWallet provides a wedding that have Atomic Invest, LLC (“Nuclear Dedicate”), an SEC-joined funding adviser, to carry you the opportunity to discover an investment advisory account (“Nuclear Treasury membership”).

All of that said, it could be extremely simplistic to blame sluggish repayments from the Us available on lender greed. People aren’t exactly requiring reduced repayments, since the borrowing and you can debit notes let them sense of many repayments as though it’re quick. If you wish to to see a really American state, wade unlock your own cell phone’s Venmo software. Just click “me” and then click to the “import.” When you have an equilibrium in your account, you’ll be given two possibilities. Solution one to will give you your finances free of charge — in “up to step three biz weeks.” Another choice is “instant,” but includes an expense level of just one.75 percent of the transfer, going up in order to twenty five to possess higher purchases. Getting entry to the currency boasts a cost, either in day or perhaps in dollars.

If you’re still unsure your finances was secure, the brand new Australian Prudential Controls Power (APRA) features a handy deposit examiner for the their website. When you provides 250,100000 with Lender An excellent and 250,one hundred thousand that have Financial B nonetheless they’re also one another within the same ADI, you will just be guaranteed for the first 250,000 – perhaps not five hundred,100. To possess brief part, the new FCS protected around one million in the deposits, but is actually after smaller in order to 250,100000. The new Australian Authorities pledges buyers dumps around 250,100 with Authorised Put-Getting Associations (ADIs) beneath the Financial Says System (FCS). Thus on the highly impractical enjoy your financial phone calls they a day, what the results are for you along with your currency? It’s also important to ascertain whether the financial imposes one limits to your amount of money — or the quantity of money bills — it needs for each and every Atm transaction.

Of a lot components of this one, since the suggested from the Payment, are consistent with the existing U.S. design of one’s Federal Put Insurance rates Operate. We see great features every single of these elements considering the newest FDIC’s feel. When it comes to deposit insurance rates, with respect to the FDIC, credit unions are no safe than simply banking institutions, but they are in addition to no less safer. Whether the organization is insured from the FDIC or from the National Credit Relationship Share Insurance coverage Fund (NCUSIF), your own places try guaranteed around the new 250,000 restriction per depositor. More to the point right here, credit unions or any other small regional banking companies commonly subject to bail-ins. And because Yotta is a great fintech organization, maybe not a vintage financial, people didn’t have deposit insurance rates from the Government Deposit Insurance Firm (FDIC).

The purpose of a real income internet casino no-deposit a lot more rules is that you don’t have to deposit. However some casinos perform want a deposit and you also is also name confirmation before your withdraw earnings. Today’s incentives, particularly no-deposit incentives (NDB) is simply designed a lot more very carefully, no associate is going to go broke attracting the new professionals that have you to definitely. After you’lso are offered a free of charge No-deposit Added bonus, it does essentially go into the kind of free Cash Bonuses if you don’t 100 percent free Spin Incentives. To get around the deficiency of real twigs when you’re nevertheless reaping the benefits of on the internet banking, let’s view several on the web banking companies and borrowing unions that allow you to deposit bucks to your membership from the urban centers for example ATMs and you will stores.

Comentários desativados.